working capital turnover ratio ideal

Answer 1 of 3. Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a company on solid.

Working Capital Turnover Ratio Meaning Formula Calculation

This is why this ratio is also called Working Capital Turnover Ratio as it measures the number of times working capital has been turned over.

. What this means is that Walmart was able to generate Revenue in spite of having negative working capital. Higher the capital turnover ratio better will be the situation. Changes in Working Capital Ratio.

The goal here is to have a high ratio of working capital turnover. This means that for every 1 spent on the business it is providing net sales of 7. Between 12 and 2.

When companies use the same working capital to generate more sales it means that they are using the same funds over and over again. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times. Working capital turnover Net annual sales Average working capital Where working capital of a company is current assets current liabilities.

Below this range company could go through a critical situation that might indicate to the firm that they need to intensely work upon their short-term assets and grow them as soon as they can. Metode lain yang dapat digunakan dalam analisis antara lain adalah receivables ratio inventory-turnover ratio current ratio quick ratio dan days payable. Working capital turnover ratio is the ratio between the net revenue or turnover and the working capital of a business.

This means that every dollar of working capital produces 6 in revenue. A high capital turnover ratio indicates the capability of the organization to achieve maximum sales with minimum amount of capital employed. A healthy ratio for WCR is between 12 20.

Working Capital Turnover Ratio Net SalesWorking Capital 15000050000 31 or 31 or 3 Times This shows that for every 1 unit of working capital employed the business generated 3 units of net sales. Current ratio current assetscurrent liabilities read more. For a firm to maintain Working Capital Ratio higher than 1 they need to analyze the current assets and liabilities efficiently.

Some startups however may have calculated their working capital turnover ratio. This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for. The working capital turnover ratio is thus 12000000 2000000 60.

What your Working Capital Turnover Ratio Means. What is the ideal working capital ratio. A higher ratio indicates a strong financial outlook for your company as the funds spent have generated an ideal number of net sales over the period.

As a general rule a high working capital turnover ratio is seen to be more positive as it indicates that the company is converting its working capital into. This company has a working capital turnover ratio of 2. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2.

Working Capital Turnover Ratio 288. Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. 60 Working capital turnover ratio.

This ratio is also known as Current Ratio Current Ratio The current ratio is a liquidity ratio that measures how efficiently a company can repay it short-term loans within a year. Formula to calculate capital turnover ratio. Capital Turnover Ratio indicates the efficiency of the organization with which the capital employed is being utilized.

Net annual sales divided by the average amount of working capital during the same year. Company B on the other hand had 750000 in sales and 125000 in working capital resulting in a. Working Capital Turnover Ratio Turnover Net Sales Working Capital.

Working capital turnover Net annual sales Working capital. Working Capital Ratio Indikasi kondisi finansial sebuah perusahaan bisa dilihat dari rasio working capital yang dimiliki. Company As working capital turnover ratio is 10 which means the company spent that 75000 ten times to generate its 750000 in sales.

Working capital turnover ratio interpretation. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. Issues with the Working Capital Turnover Ratio.

Working capital Turnover ratio Net Sales Working Capital 420000 60000 7. The Working Capital Turnover Ratio is used to measure how much revenue is generated per dollar of working capital investment which is in basic terms also referred to as the net sales to working capital ratio WC. It also means that the business is effectively using its current.

Net annual sales total sale by the company during the accounting period. An extremely high working capital turnover ratio can indicate that a company does not have enough capital to support its sales growth. Take the Next Step to Invest.

240000 140000 280000 1000002. The higher the sales the more the profits and therefore the more. The calculation of its working capital turnover ratio is.

Working Capital Ratio 2015 4384 3534 124x. It is important to look at working capital ratio Working Capital Ratio The working capital ratio is the ratio that helps in assessing the financial performance and the health of the company where the ratio of less than 1 indicates the probability of financial or liquidity problems in the future to the company and it is calculated by dividing the total current assets of the company with its. Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x.

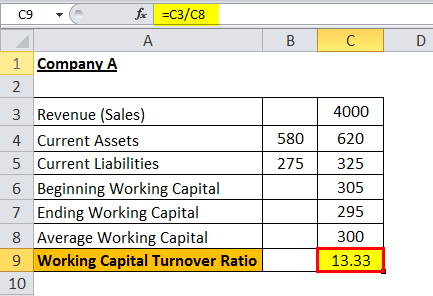

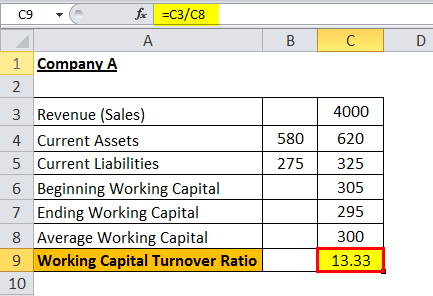

Putting the values in the formula of working capital turnover ratio we get. The working capital turnover ratio. Compute working capital turnover ratio of Exide from the above information.

300000140000 214 Average working capital. A positive turnover ratio means that a business is using its working capital justifiably. Ratio dfrac 280 000 140 000 2 WCTurnoverRatio 140000280000.

This means that for every one dollar invested in working capital the company generates 2 in sales revenue. The working capital turnover ratio is calculated as follows.

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Efinancemanagement Com

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Example And Interpretation